The Finance Brokers Association of Australia (FBAA) says recent claims in the industry media that a high number of brokers are closing shop are not correct, with managing director Peter White AM pointing out that those making the claims are likely driven by commercial self-interest.

“It’s pretty obvious why some may want to push this questionable narrative and that’s to build their business.

“My message to them is to take out an ad if you have a message to sell, but please stop trying to destabilise our industry.”

Mr White said there will always be brokers leaving through retirement or change of career, but overall the number of brokers is well up on last year, and he revealed the FBAA has recently conducted independent research that proves it.

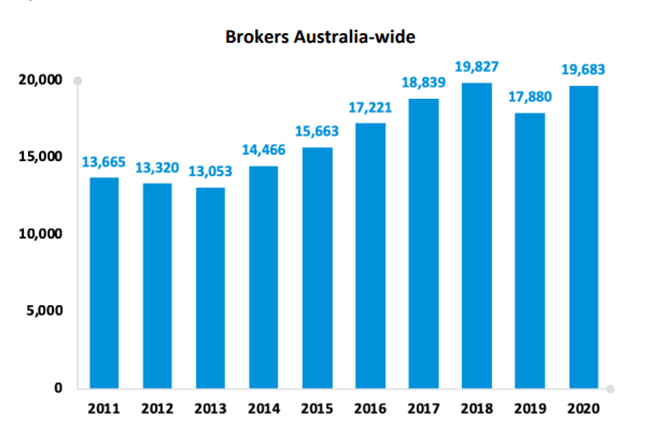

The association’s annual ‘Consumer to Broker Ratio Report’, compiled by Core Data, has found that, “The total number of credit representatives in Australia sits at 19,683 in 2020, up from 17,881 in 2019.”

Furthermore, the report states, “The dip in 2019 interrupted a period of continuous growth since 2012, which was likely driven by the royal commission.”

The total number of licensees identifying as finance and mortgage brokers in Australia has also increased.

Mr White also pointed to the FBAA’s own figures that show FBAA membership at the end of the 2021 financial year had increased by 10.8 per cent over the same time at the previous year. The number of members was 9,034 as of June 30 and is now well over 9,200, with more than 90 per cent being customer-facing finance and mortgage brokers.

He acknowledged that there have been plenty of challenges for the broking sector over the past few years but said many industries have faced significantly more heartache during the pandemic.

“Despite the challenges our industry is strong. Right now most brokers have never been busier, so let’s focus on the strength, resilience and professionalism of our great industry.”

Source: Consumer to broker ratio report – FBAA / Core Data – February 2021